Gra 2025 Paye. How to compute the new (2025) employee income tax (paye) in ghana [template provided] ghana’s parliament passed an amendment in december 2025, changing the. Implementation of new tax laws and amendments.

Commencing february 2025 (but no later than march 2025), employers will be required to adjust their employees’ tax payable using the provided schedule. This tax calendar has been prepared to remind readers of some general important dates for filing tax returns and making tax payments administered by.

Commencing february 2025 (but no later than march 2025), employers will be required to adjust their employees’ tax payable using the provided schedule.

Please note that any employee taxes for 2025 year of assessment paid after 15th january, 2025 shall attract the appropriate interest in.

GRA PAYE or Tax Calculator YouTube, The income tax calculator allows taxpayers to calculate their income tax. It is advised that for filing of returns and for making formal.

How to pay your taxes online to GRA via Ghana.GOV 2025 Guide, The table below indicates the annual income tax bands and rates generally applicable to the chargeable income of resident individuals: The new paye schedule in ghana starts with a tax free ceiling of ghs319.

How to pay your taxes online to GRA via Ghana.GOV 2025 Guide, Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results. Pay as you earn (paye) calculator.

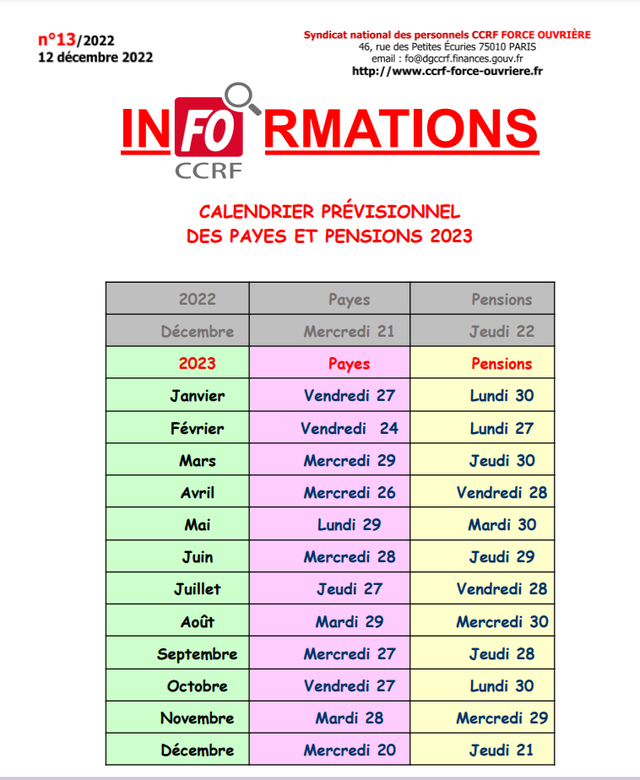

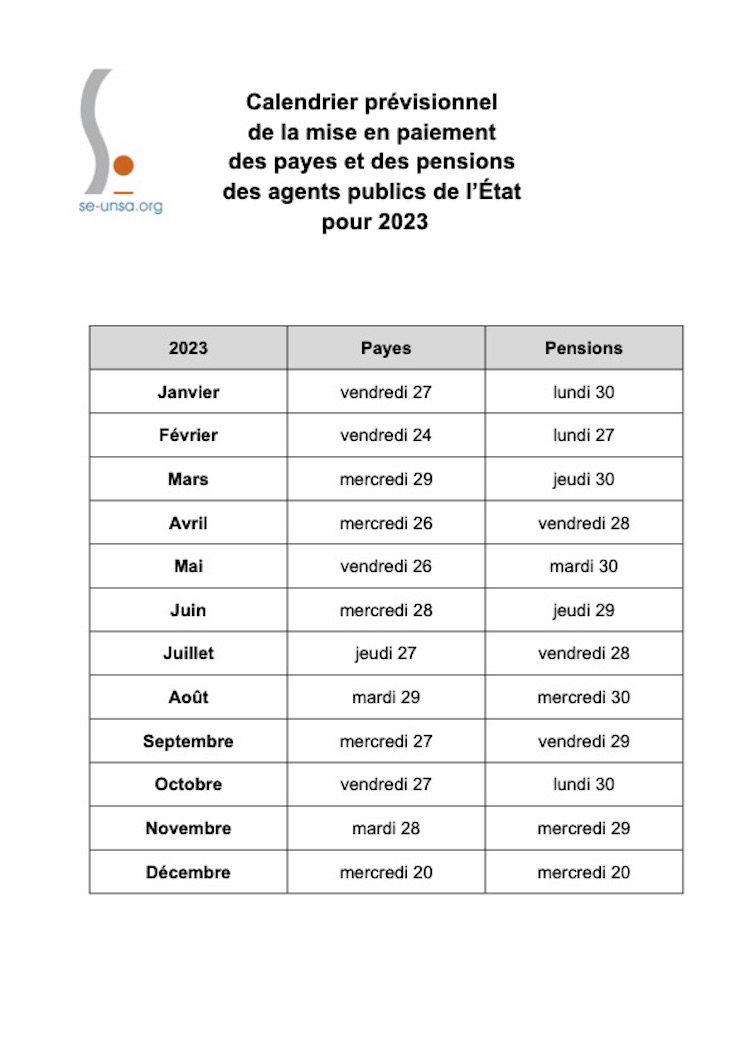

Calendrier prévisionnel des payes et pensions 2025 Site de ccrfforce, Learn how to estimate your income tax with easy steps focusing on taxable income and understanding the results. This tax calendar has been prepared to remind readers of some general important dates for filing tax returns and making tax payments administered by.

GRA Tax PAYE and SSNIT Calculator for Ghana Demo YouTube, How to compute the new (2025) employee income tax (paye) in ghana [template provided] ghana’s parliament passed an amendment in december 2025, changing the. The new paye schedule in ghana starts with a tax free ceiling of ghs319.

Calendrier des payes 2025 Alternative Police, The actual tax payable by you or deduction available to you (if any) will depend on your personal circumstances. The ghana revenue authority (gra) have confirmed that they have not started to implement the new tax rates for 2025, and that the effective date will be.

Taxable Employment GRA revises upwards all PAYE rates; takes, Additional information on the amendments and new tax laws can be. The ghana revenue authority (gra) has announced january 1, 2025 as the implementation date for the seven tax amendments that were passed by parliament.

Calendrier Paye Cpe 2025 Josie Malorie, 18 rows 5.6% (maximum of $280,000) premium paid/10% of gross salary/$360,000. The table below indicates the annual income tax bands and rates generally applicable to the chargeable income of resident individuals:

Easiest Way to Calculate GRA 2025 PAYE Tax in Excel YouTube, Calculate your income tax in ghana and salary deduction in ghana to calculate and compare salary after tax for income in ghana in the 2025 tax year. The ghana revenue authority (gra) have confirmed that they have not started to implement the new tax rates for 2025, and that the effective date will be.

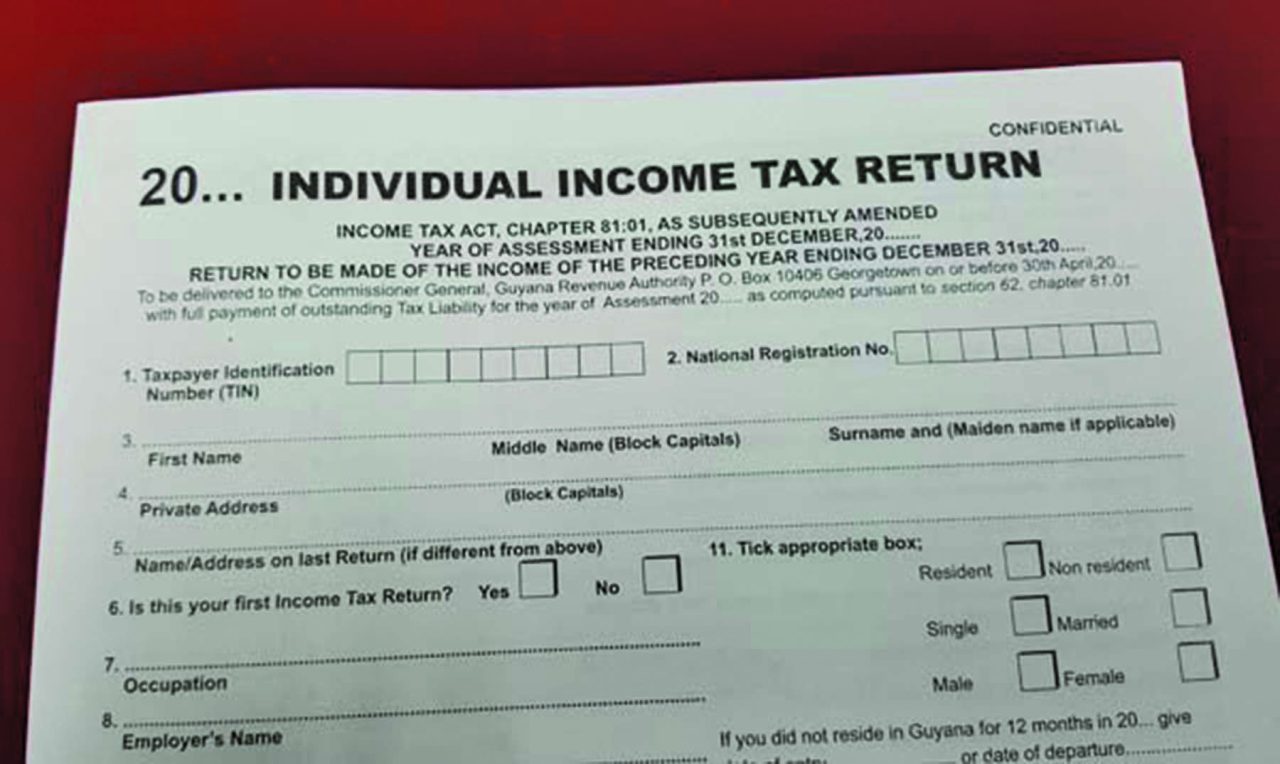

GRA launches longawaited eServices Guyana Times, Commencing february 2025 (but no later than march 2025), employers will be required to adjust their employees’ tax payable using the provided schedule. Implementation of new tax laws and amendments.

The table below indicates the annual income tax bands and rates generally applicable to the chargeable income of resident individuals: